Attempts by a pair members of Congress to remove language permitting political activity by churches in the House of Representatives’ “mini-bus” appropriations bill will not be considered further as of Monday evening. The bill is now likely to proceed on this week with language prohibiting the Internal Revenue Service (IRS) from denying tax exemptions due to political activity.

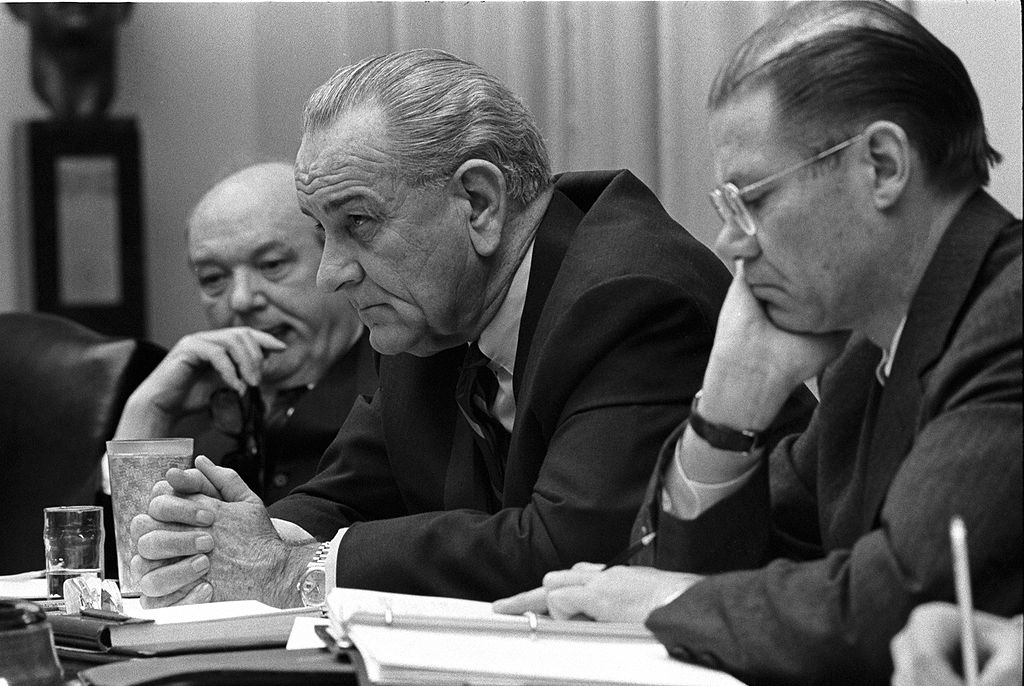

Reps John Lewis (D-Ga.) and Debbie Wasserman Schultz (D-Fla.) have both proposed amendments to the mini-bus that would have preserved the Johnson Amendment. Named after then-Sen. Lyndon B. Johnson, the Johnson Amendment has prohibited 501(c)(3) organizations from engaging in partisan politics since 1954. The House Committee on Rules decided Monday not to consider the amendments and the amendments are now further blocked from floor debate, according to David Thompson, vice president of public policy for the National Council of Nonprofits.

Requests for comment from Lewis and Wasserman Schultz were not returned prior to publication.

The provision in question, Sect. 112 of the mini-bus, prohibits the IRS from using funds to deny churches, integrated auxiliaries of churches, or associations or conventions of churches exempt status under Sect. 501(a) due to participation or intervention in political campaigns. An exception is carved out for when the IRS commissioner determines that an exemption should be denied and notifies the House Ways and Means Committee and Senate Committee on Finance within 30 days.

In such scenarios, a denial must not be effective sooner than 90 days of notification.

The exception’s timeframe would do little to prevent groups from popping up as churches shortly prior to an election, engaging in political activity, and walking away scot free, according to Thompson. This is because churches — a term that Thompson says applies to all houses of worship — are automatically exempt. They need not seek IRS approval.

“They can pop up. You can do your bad deeds and you can disappear,” Thompson said. “And people donating, most likely, will get a tax deduction.”

The National Council of Nonprofits, along with the Council on Foundations, Independent Sector, and National Human Services Assembly, issued a joint statement in opposition of the committee’s choice not to further consider the amendments late Monday. The statement highlights petitions and other opposition members of the religious and larger nonprofit communities have had to any sort of repeal of the Johnson Amendment.

“The Johnson Amendment serves as a critical firewall between political activity and nonprofit organizations,” Daniel J. Cardinali, president and CEO of Independent Sector, said in the release. “Gutting this firewall would tear nonprofits away from their missions, erode public trust in the sector, and help political donors dodge taxes at the expense of the federal treasury.”

Thompson expects for the mini-bus to go to the House of Representatives this week. The Senate has its own bill without a provision similar to Sect. 112. Assuming both bills pass their respective houses of Congress, it is expected that the Johnson Amendment will be an issue that is fought over during conference to combine the two bills.

Efforts are not being made to mobilize nonprofits at the moment. Congressional action has exhausted the sector and many leaders want to focus on mission. Mobilizing now, without the potential payoff of having Sect. 112 removed, would be akin to crying wolf, according to Thompson. Efforts will instead pick up prior to conference between members of the House and Senate, focusing on the sector’s opposition to a repeal or weakening of the Johnson Amendment.

“It’s important to remind Congress that most people don’t want this,” Thompson said.